Atal Pension Yojana (APY): Earn ₹5000 Pension by Investing Just ₹210 Monthly!

- Learn how Atal Pension Yojana (APY) offers a secure ₹5000 monthly pension with a small ₹210 investment, and explore benefits, eligibility, and application process.

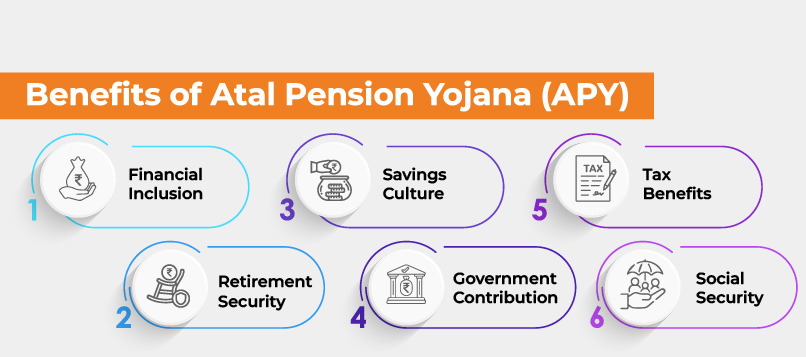

- The Atal Pension Yojana (APY) is a government-backed pension scheme aimed at helping people from low-income backgrounds secure their retirement. For as little as ₹210 per month, contributors can receive a pension of up to ₹5000, ensuring financial stability. This article will guide you through the scheme’s structure, benefits, eligibility, and application steps, offering essential insights into how this plan can serve as a safety net for those with limited savings options.

Overview of Atal Pension Yojana (APY)

Understanding the Atal Pension Yojana (APY) :

- The Atal Pension Yojana is a pension scheme introduced by the Government of India in 2015, targeting the unorganized sector. Here’s a look at its key features:

- Objective: Provides a guaranteed pension to Indian citizens after retirement.

- Minimum Age: 18 years

- Maximum Age for Entry: 40 years

- Pension Range: ₹1000 to ₹5000 per month, based on monthly contributions.

Key Statistics

- Over 4 crore subscribers have already joined APY as of [latest available data].

- The government co-contributes 50% of the user’s contribution or ₹1000 annually, whichever is lower, for eligible applicants.

- The scheme guarantees fixed pension benefits, ensuring lifelong security.

- Contributions to APY are tax-deductible under Section 80CCD of the Income Tax Act.

How APY Works and the Contribution Structure

How Does APY Guarantee a ₹5000 Pension?

- APY’s contribution structure allows individuals to select their desired pension amount. For instance, to receive a ₹5000 monthly pension, a subscriber aged 25 would need to contribute approximately ₹210 monthly until reaching 60 years of age.

Example Contribution Table:

| Pension Amount | Age 18 | Age 25 | Age 30 |

|---|---|---|---|

| ₹1000 | ₹42 | ₹76 | ₹116 |

| ₹3000 | ₹126 | ₹202 | ₹302 |

| ₹5000 | ₹210 | ₹346 | ₹500 |

- This structure showcases how early subscribers benefit from lower contributions, maximizing the scheme’s long-term returns.

Application Process and Eligibility Criteria

Eligibility and How to Apply for Atal Pension Yojana :

To join APY, one must meet the following eligibility requirements:

- Age Limit: 18-40 years

- Bank Account: An active bank account is necessary for automated deductions.

- Aadhaar Linking: Essential for verification and subsidy benefits.

- KYC Compliance: To be eligible for government co-contribution.

Application Process:

- Step 1: Visit any national bank and request an APY form or apply online if the bank supports it.

- Step 2: Submit required documents such as Aadhaar, proof of age, and proof of income.

- Step 3: Set up an auto-debit mandate to ensure contributions are deducted monthly.

- Step 4: Select your preferred pension plan and confirm your subscription.

- This process ensures that beneficiaries seamlessly contribute, with the assurance of receiving a fixed pension on retirement.

The Impact of APY on an Individual’s Financial Security : Consider Ramesh, a 28-year-old farmer with limited savings but an APY subscriber. Contributing ₹376 per month, Ramesh will secure a monthly pension of ₹5000 after retirement, providing his family with stability even without any significant savings. This example demonstrates the APY’s potential to support financial well-being for those in unorganized sectors.

Why You Should Consider the Atal Pension Yojana : The Atal Pension Yojana offers a simple, affordable way to ensure financial stability post-retirement. For individuals without significant savings or access to a corporate pension, APY provides essential security. Interested readers should consider enrolling early to maximize their contributions and secure a sustainable future.

What is the maximum pension I can receive under APY?

The maximum pension under APY is ₹5000 per month.

Can I withdraw my contributions early?

Early withdrawal is restricted to cases of terminal illness or death.

Are contributions to APY tax-deductible?

Yes, they qualify for tax deductions under Section 80CCD.

What happens if I miss a contribution?

Missed contributions incur a penalty but will not result in cancellation; delayed payments are resumed with penalties.